Transfer of small property without inheritance enrollment

Escrito por fernandes em 31 de Dezembro, 2025

Probate in Arizona is much easier and cheaper than in several various other states. While many states have actually embraced the Uniform Inheritance Code and gotten rid of inheritance and estate taxes, concerning 20 states still bill beneficiaries a charge for the opportunity of acquiring even small amounts of property. Arizona has no inheritance or inheritance tax.

Establishing whether an inheritance is transferable making use of an affidavit

What is ‘estate property’? Estate property is personal property that the deceased owned only in his/her name. A stock, auto, or savings account that only births the deceased’s name on the action is estate residential or commercial property. Savings account that are case (pay after fatality) accounts; joint savings, examining, or investment accounts are exempt to probate. Vehicles with a second individual on the title act or a beneficiary classification; and life insurance policies with a named beneficiary are also not subject to probate.Перейди по ссылке View michigan affidavit of small estate in PDF На нашем веб-сайте None of these joint or probate assets are consisted of in the calculation of the estate’s dimension. If you build up all probate properties and the overall is $75,000 or much less, Arizona regulation enables heirs to use a basic and cost-effective procedure to carry out the estate. It is called ‘Sworn statement of Foreclosure of All Personal Property.’

Procedure for certifying inheritance for Small residential property using a sworn statement

The procedure for filing an affidavit is plainly laid out in the laws. ARS §& sect; 14-3971 states that an affidavit can not be utilized up until a minimum of 30 days have actually passed given that the fatality. Additional demands for making use of the sworn statement process are that no individual agent (administrator) has actually been appointed by the court and the worth of the personal property does not surpass $75,000. Personal effects is basically anything that is unreal estate. This procedure can likewise be used if extra personal property of up to $75,000 is found after the closure of traditional probate proceedings. In this latter situation, the law requires that the individual representative be dismissed and the probate proceedings have actually been closed for greater than a year.

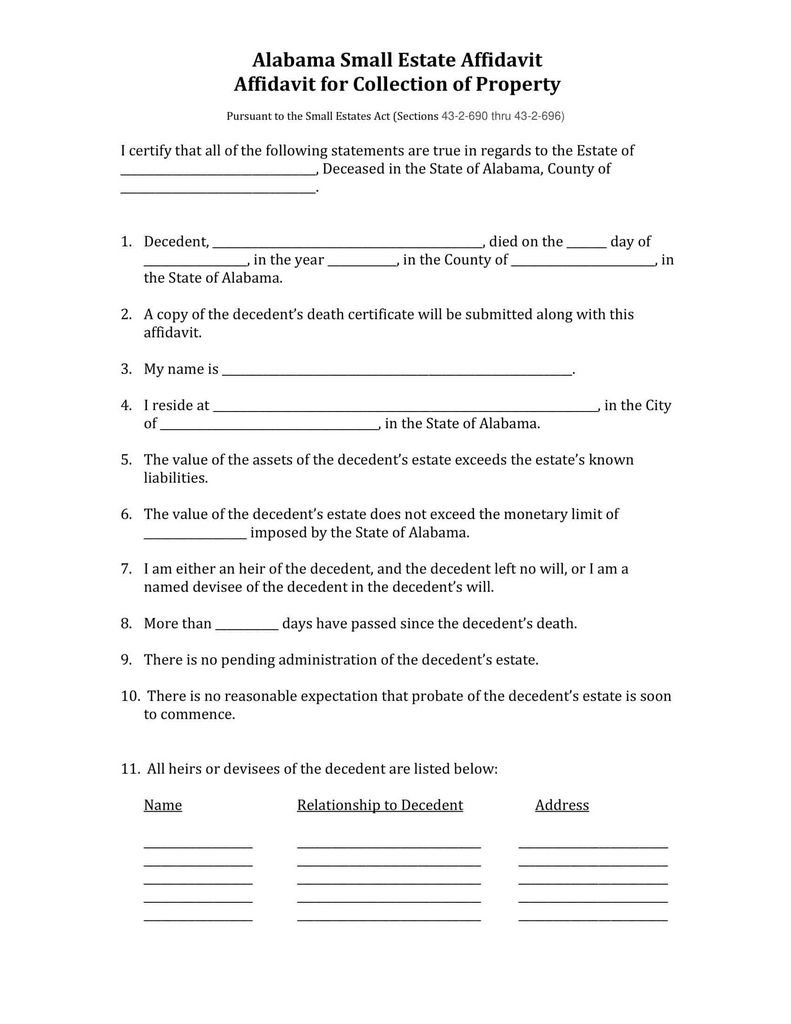

Claimants to the estate finish a type called an ‘Sworn statement of Collection of All Personal Property.’ You can find this type in the self-help area of the Superior Court website. You search for www.azcourts.gov, click Superior Court, then click on the county where you live. Most likely to the self-help area of the Superior Court website for the area and discover the probate types and directions. Total the Testimony and sign it prior to a notary or the region staff. Then take the authorized and notarized Affidavit to a financial institution, the departed company (if there is a wage debts), or another institution that holds the deceased’s personal effects. Some financial institutions might require that the Affidavit be licensed by the court. In this case, you will certainly need to visit the staff of court, pay a cost, presently $27.00, and have your testimony licensed. You may likewise need a duplicate of the fatality certificate when you submit your affidavit. You may send out duplicates of the testimony and fatality certificate to non-local firms. The affidavit will likewise permit the DMV to alter the title of any kind of car had by the deceased to reflect the adjustment in possession.

The testimony needs to clarify your partnership to the departed and why you are entitled to the personal property. It asks whether the deceased had a will and whether you are named in it.

As we age, we require to meticulously think about exactly how we want our accounts to be dealt with after we pass away. Adding family members to the ownership of your lorry or your bank accounts is a huge threat. When you have these accounts collectively with one more person, the co-owner has equal rights to the lorry or cash in the account. Consider joint accounts only if you are definitely particular that you can rely on the other individual to look out for your benefits. There have actually been too many instances where a kid or brother or sister has actually taken all the money, leaving the original account owner with zero equilibrium. That’s not a danger you want to take. A safer alternative is to make your checking account sheath accounts. COVERING (payable on death) accounts cost nothing to establish; there are no restrictions on the quantity the account can hold; and the recipient has no right to the money while you live. The only drawback is that you can not designate an alternate beneficiary.

Automobiles can be dealt with in much the same method, using a recipient designation to move the vehicle after death. You can download a straightforward kind from the Arizona Division of Electric motor Autos site. You simply complete the form, have your trademark notarized, and present the kind to the MVD, connected to the automobile’s present certificate of title. The MVD will then issue a brand-new certificate of title with the beneficiary classification. A beneficiary classification is a much more safe means to move possession after your fatality than joint ownership.

Affidavit of transfer of ownership of realty

There is likewise a kind for the Testimony of Transfer of Title to Real Property, yet this is rather extra difficult. It can be submitted by a partner, small youngster, or grown-up beneficiary. The Sworn statement of Transfer of Title can not be submitted with the court until at the very least 6 months after the fatality. The person or persons signing the Testimony has to accredit that the court has not designated a personal agent or that the probate process were closed more than a year earlier and the individual rep has actually been discharged. The signatures must license that the value of the residential or commercial property is $100,000 or much less after all liens and encumbrances are discharged. They should accredit that nobody apart from the signatures has any type of civil liberties to the property which no taxes are due. The Affidavit allows the signatures to declare help instead of propertystead ($18,000), estate tax exemption ($7,000), and household help. As soon as completed, the Sworn statement should be filed with the court, together with the original title web page of the Probate Application and the initial will (if any type of). Much more thorough details on this procedure can be discovered in the guidelines published on the High Court Self-Help Centre.